The following content is informational only. When making business decisions, we encourage you to seek personalised advice from qualified professionals.

As the high street evolves across the UK and Europe, larger, chain businesses become less common and customers are embracing the shop local movement.

This means there’s a real gap in the market for independent brands to showcase their offering – and it’s more important than ever for small businesses to partner with the right retailers.

In other words, now is the perfect time to get your foot in the door and grow your business – both locally and overseas.

But, with the impact of Brexit, complex import duties, shipping logistics and border regulations to take into account, it can be difficult to navigate.

At Faire, we want to ensure our community has the right tools to successfully sell outside the UK with confidence. Here’s what you need to know to do just that.

The impact of Brexit

When it comes to selling internationally, Brexit has certainly made things more complicated for British retail brands.

Import duties and tax, customs processes, and shipping requirements have all been impacted. At the same time, sales made to the EU will now be subject to customs declarations, VAT and potential tariffs that didn’t exist before.

The B2B sales of goods shipped from the UK to the EU will also no longer be subject to the Distance Selling regime, and will instead be subject to the import and export regimes.

In some EU countries, your VAT number will no longer apply and you’ll need to appoint a tax representative.

Our advice? If you’re in a position to do so, consider investing in a customs broker. For those that aren’t, make the most of free resources out there, including our guide to VAT orders in the UK.

Import duties and tax

Products sold outside the UK are generally subject to import duties and taxes. As a brand, what do you need to know?

Make sure you’ve allocated the time and resources to prepare your shipping documents and double check you’ve got the right tariff codes. Taking extra care at this stage will likely save you unnecessary delays and disgruntled buyers later.

At Faire, we make it easy for sellers to ensure their products make it to customers by providing shipping labels with and the commercial invoice paperwork for customs.

Legal requirements

It’s also important to know whether or not you can legally export your products to each destination country.

Different countries have different legal requirements and restrictions, and it’s important to thoroughly understand them before conducting any business.

Check EU and US regulations for labelling and packaging requirements, approved ingredient lists, tariff code requirements, and any other laws or guidelines.

It’s also crucial to note that certain regulations and requirements may have changed, or be in the process of changing due to the impact of Brexit. For brands in the UK, it’s more important than ever to double check you’re up to date on the latest guidelines.

For any queries, or if there’s anything you’re uncertain about at this stage, we recommend consulting a customs broker for advice before shipping internationally.

Calculating fees

Another aspect to understand is how to calculate the tax you or your buyers owe.

Typically these prices are set by customs, and the exact amount depends on the product and country you’re shipping to.

If you’re shipping to the US, keep in mind the following considerations:

- VAT (known as sales tax in the States) will differ on a state by state basis – there is no single tax rate across the United States.

- It’s important to triple check the VAT implications of the state you’re shipping to ahead of time.

If you’re shipping to the EU, keep in mind the following considerations:

- Your buyers are responsible for paying VAT at the border when collecting the goods as well as any other duties. They will be notified of this requirement during checkout.

- In this case, VAT charges will not be remitted to you regardless of whether or not your brand is VAT registered.

You can browse our website for specific advice about VAT in the EU.

Communicating with customers

Customer satisfaction comes above all else, so you need to know when your products will be delivered. And, if there are any issues or delays during the shipping process you and your customers need to be updated ASAP.

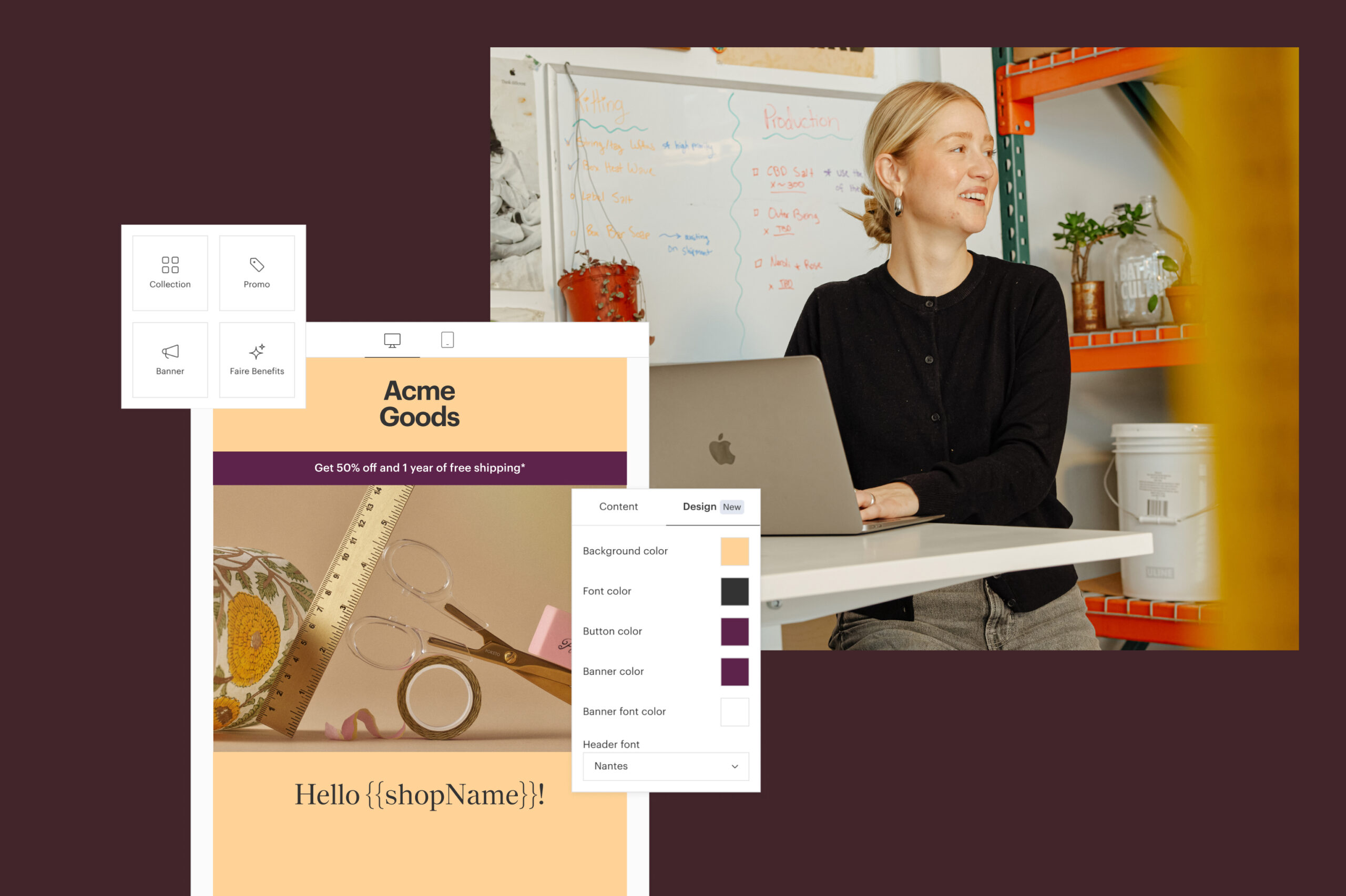

Of course, not all delays can be avoided – so it’s important to go out of your way to communicate when delays do happen. A personalised message explaining the delay and promising to resolve it quickly can go a long way to soothing any customer frustration. When you sell with Faire, you can send a quick message to a retailer directly through the platform.

All of this requires visibility and an understanding of where your products are at all times. So if you aren’t shipping with Faire, make sure you partner with a shipping company that provides this detailed shipping information, so both you and your customers are kept in the loop.

International selling made simple

There’s a lot to navigate for brands who want to sell their products overseas. But if you’re ready to take that step, we’ll be there to support every step of the way.

When you sell internationally with Faire, we make everything easy. We’ll provide shipping labels and commercial invoice paperwork, for free. To learn more about shipping with Faire, visit our help centre.