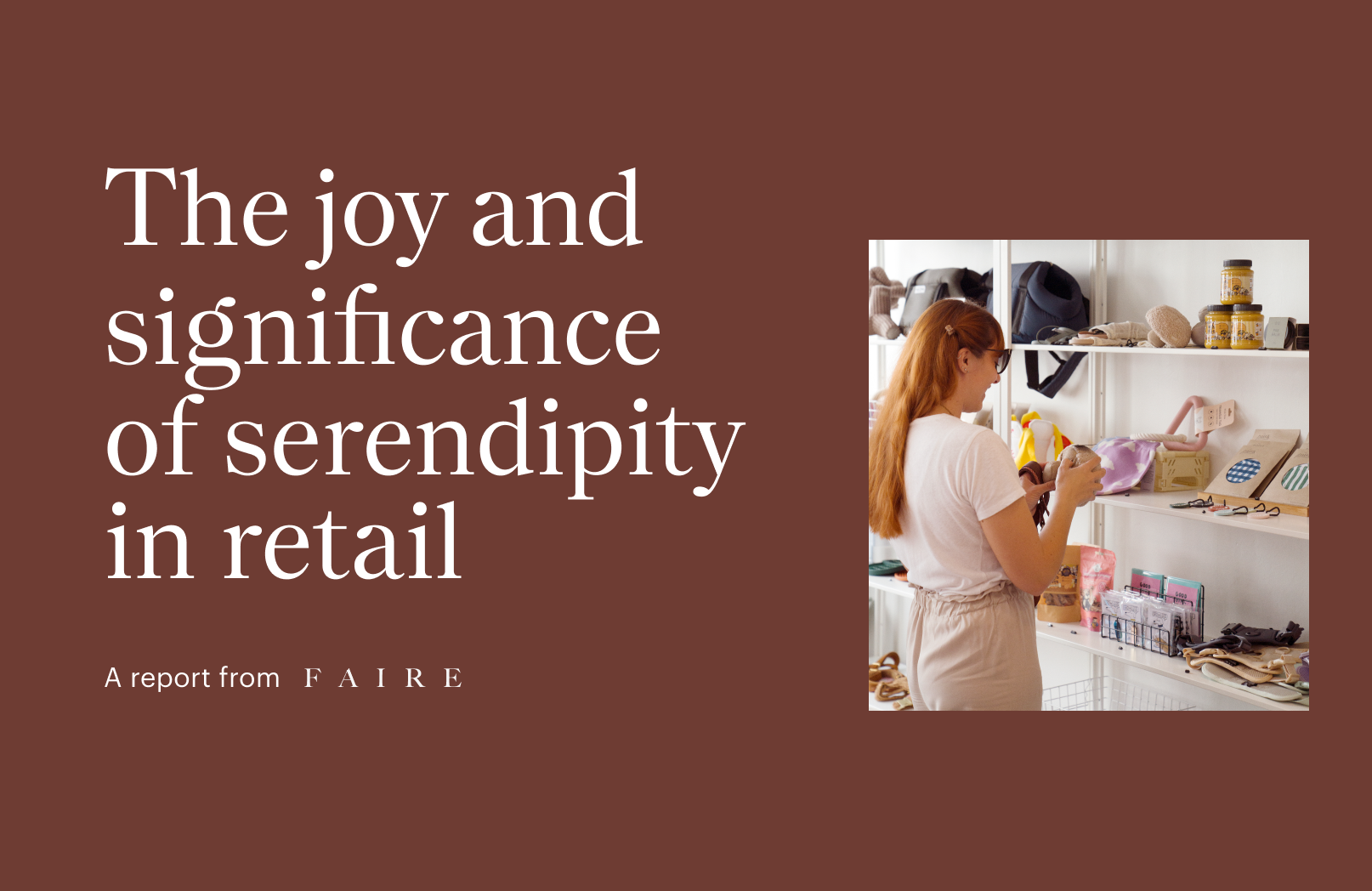

A report exploring the future of independent retail in the UK. Commissioned by Faire, with research conducted by Opinium.

The big picture

These days, independent retailers have no shortage of challenges. In the wake of the pandemic, they face one of the most turbulent times in retail history: macroeconomic uncertainty, global supply chain disruptions, energy crises, the pressure of generational inflation and a cost-of-living crisis.

We commissioned this research to build a better understanding of not just the pain points British independent retailers face today but also the opportunities available to them to succeed.

Overwhelmingly, independent retailers said that the cost-of-living crisis was the biggest current threat to their businesses, with just a quarter feeling optimistic about the future of independent retail in Britain. And yet, the British public wants to support local shops, even if the perceived cost is holding nearly half back, and young people said that they shop locally to save money.

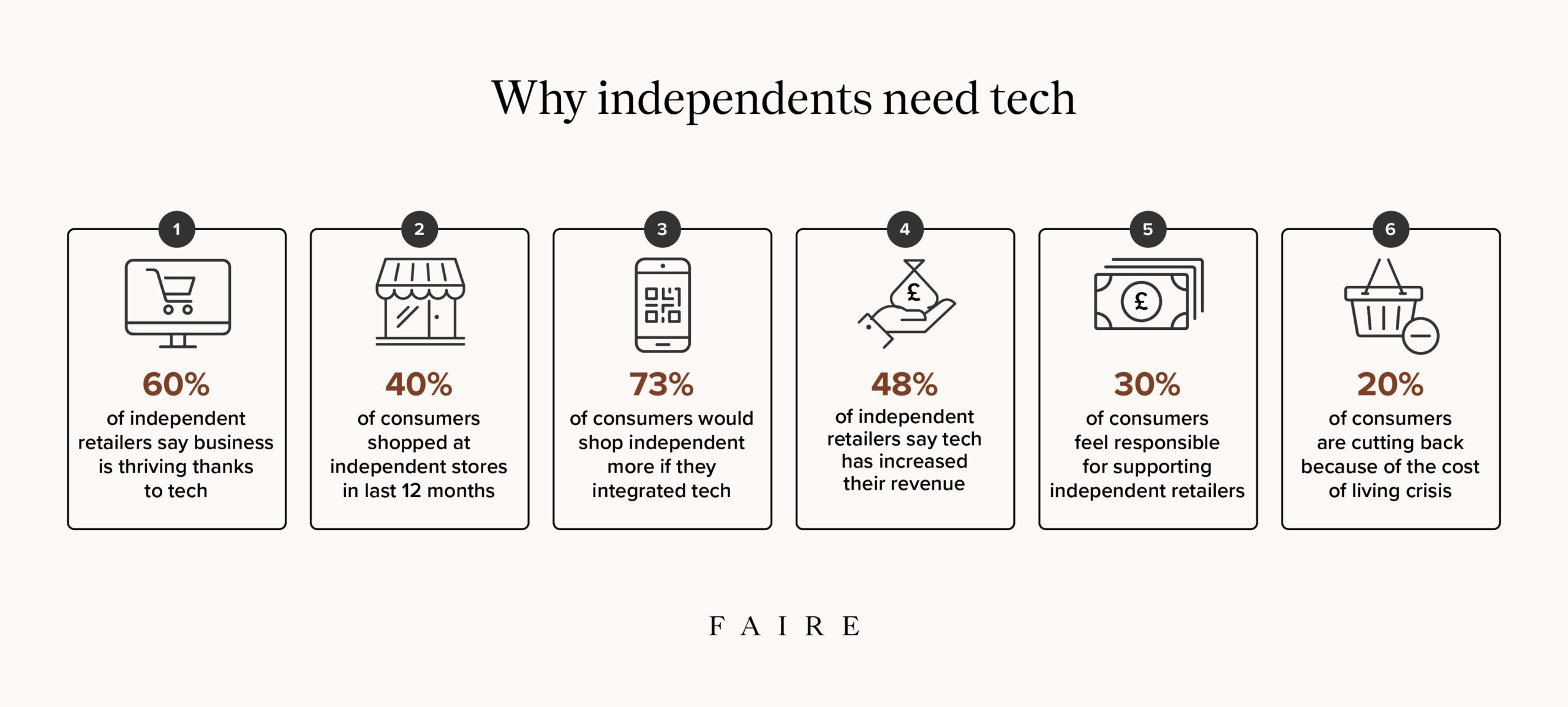

Rapid innovation across the technology landscape is promising. Retailers with both digital and brick-and-mortar operations are thriving since going digital, whether they’ve decided to source new products from online wholesalers like Faire, use technology for back-office functions or provide omnichannel shopping experiences. And this delights the modern shopper: Consumers confirmed the draw of digital, with three-quarters saying they were more likely to shop at independent retailers if they incorporated at least one digital service.

Our hope with this report is that we can surface information, tools and support that independent retailers need to thrive in light of today’s challenges. We know that independent retailers are the backbone of local economies, which means shopping (and providing the best shopping experience) is more important than ever.

The changing face of independent retail in the UK

Core customers support independent retail

In terms of market share, large online marketplaces like Amazon and Asos still dominate the industry, and 64% of consumers used at least one of them in the last year. However, many British consumers are also staying local, with 40% purchasing items from an in-store independent retailer in the last year and a third (31%) shopping with independent retailers online.

Shoppers ages 34–55 strongly support independent retail, using online options significantly more than their younger counterparts. An impressive 70% of 34- to 54-year-olds and 71% of 55-year-olds use online marketplaces, while only half (49%) of 18- to 34-year-olds do the same.

Young consumers are also the least likely demographic to shop with independent in-store retailers, with only 36% of younger adults (ages 18–34) opting to shop in-store in the last 12 months, compared to 44% of 35- to 54-year-olds and 41% of those over 55.

This means that Britain’s older demographic is one of the most reliable, presenting both a risk and an opportunity for independent retailers.

Why shop local?

Community

When asked about the main purpose of in-store independent retailers, consumers expressed a wide range of views, from creating curated shopping experiences to supporting local brands and businesses. The most common response was providing a sense of community, cited by 40% of consumers and 54% of businesses. Indeed, 20% of consumers in the UK say indie shops provide a space to catch up with locals, and nine in 10 retailers agree that independent retail has a positive impact on the community. In Scotland, just under a third (31%) of consumers think that independent in-store retailers are important for fostering a strong sense of community.

Discovery

Another key reason shoppers choose independent stores is because it provides an opportunity to discover new things. Two-thirds (64%) said independent retailers introduced them to new products they wouldn’t have otherwise found. Those in the LGBTQ+ community are especially drawn to this benefit, with 77% agreeing that in-store shopping at indie spots helps them find new products. (The same sentiment is echoed by retailers, nine in 10 of whom agreed that independent retail helps people connect with local brands and products.)

Personalisation

A quarter (24%) of UK adults say they shop at independent stores to enjoy a curated experience and a further 42% enjoy being able to request specific products from shop owners.

Retail therapy means business

This is a pivotal time for local stores to assess their strategies: Nearly half (48%) of the consumers surveyed believe the role of independent retailers has changed, and 81% of retailers agree.

One trend shows that British shoppers see independent in-store retailers as well-being hubs: 48% of all UK adults said browsing neighbourhood shops is therapeutic, a sentiment shared by more than half (57%) of ethnic minority Brits. In-store shopping with independent retailers makes them feel less alone (39%), more at peace (46%) and provides a haven from the often overwhelming larger chain retailers (39%).

With consumers citing so many benefits to shopping with independent retailers, why is it so hard to unlock growth?

Diverging beliefs about cost

Cost of living hinders shopping habits

Persisting inflation and the cost-of-living crisis are forcing consumers to cut back on spending, and many are compensating by shopping at large online marketplaces or chain stores. One in five Brits shop less at indie stores due to the cost of living, and 48% think independent retailers are too expensive compared to larger chains.

Young people find savings in independent stores

Thankfully, some consumers actually see the independent retail sector as a valuable way to budget. This is particularly true for younger shoppers, ages 18–34, a quarter of whom said they save money at independent stores – giving retailers a potential audience to tap into.

But independent retail is about more than cost

While some consumers might find independent retailers too expensive, the survey found that Brits prefer independents over big-box retailers for a variety of other reasons, including being able to support their local communities, finding new and interesting products, and the great customer service they provide.

Many also cited social good as a reason to shop independent, with 32% saying it allows them to reduce their carbon footprint and 20% saying they provide more sustainable products. This interest is reflected on the Faire platform, with retailers in the UK spending over nine figures in volume on products that are eco-friendly, women-owned or handmade over the past year. One of the most popular product categories for UK retailers shopping on Faire are products not sold on Amazon, demonstrating that consumers shopping at independent retailers are doing so to find unique products they can’t get from online channels.

Clearly, there are opportunities for retailers that lean into their advantages and provide unique non-commodity products that appeal to their customers’ interests and values. Combined with the adoption of digital tools that allow them to operate as efficiently as large chains, this points to a bright future for independents.

The future of independent retail in the UK

Retailers will need to adapt to thrive

Given these challenges, some consumers have negative views about the future of independent retail, particularly if the industry doesn’t adapt. Only a quarter (24%) of retailers within the sector itself and one in 10 (11%) consumers said they have a positive outlook for the economic growth of independent retail. More broadly, over half (59%) of consumers predict poor economic growth on their local High Street over the next 12 months.

And while a quarter (26%) of young adults are more positive when it comes to the economic growth of independent retailers, only 11% of those over 35 feel the same way, and the majority is still less than confident.

It’s little surprise, then, that nearly three-quarters (73%) of consumers think independent retail businesses need to be open to change over the next 10 years. Thankfully, even among rapidly changing macroeconomic circumstances, 70% of retailers are optimistic about their ability to adapt.

Digital innovation is a powerful step forward

One key strategy is digital innovation: Three-quarters (73%) of consumers say they’re more likely to shop at an independent retailer if it incorporates at least one type of digital service.

For 64% of consumers, the ability to shop digitally and in-store enhances their experience, which means digitisation could be the key to encouraging consumers to shop local. Retailers agree, with 92% saying that digital innovation is a positive driver for their business. What’s more, 29% of UK adults favour a hybrid model that provides both in-store and digital purchasing options.

Other digital capabilities proved popular too: 35% of UK adults are more likely to shop at independent retailers if they offered the ability to check availability online, while 31% would take advantage of click-and-collect capabilities.

Friend or foe? How retailers view tech

Thriving businesses will pair digital and in-store operations

The pandemic kick-started a wave of technology adoption across Britain’s retail sector: As of 2021, more than 70% of Faire’s own retail customers had taken their businesses online through new websites, social media marketing or live shopping on FaceTime. Pre-pandemic, less than 20% had an online presence.

Perhaps given this, retailers are already optimistic about providing in-store and digital solutions for customers. Specifically, two-thirds (64%) believe that e-commerce platforms (sites that can host the retailer’s online store) are helpful to their business, and 61% of SMBs that operate both in-store and digitally report that their business is thriving. Of the independent retailers who have adopted at least one form of technology, 20% believe that it helps level the playing field with the big-box retailers.

However, there’s still more to be done. Despite the fact that 95% of retailers know which e-commerce platforms are available to them, only 62% currently use them.

Retailers are embracing technology

To remain competitive and agile in the changing market, retailers are adopting a range of technological tools beyond e-commerce platforms.

Customer-facing technology is currently the most common choice: 90% of retailers use technology to take payments, 85% use some form of sales platform and 76% use marketing software.

Back-of-house solutions are also popular, with 77% of retailers utilising tax and accounting technology, and 13% planning to sometime in the future. According to senior business decision-makers, the adoption of accounting software was rated the second most helpful technology (47%) for retailers.

Though not quite as prevalent, analytics (57%), inventory management (57%) and wholesaling technology (49%) are on retailers’ lists to adopt in the future (27%, 25% and 19%, respectively).

Clearly, there is still a significant opportunity for value to be realised from these technologies.

Tech anxiety is a potential blocker

For retailers who have embraced digital innovations, it’s already paying off: Half (48%) reported increased revenue, 46% reported improved operational efficiency and 39% reported better customer satisfaction. This is excellent news!

Like anything new, though, technology brings with it some concerns: 39% of retailers worry about cyber security, 34% about accessibility for their customers and 32% about the possibility of products being displayed inaccurately online. There’s also financial risk: 64% of retailers say they’d need to see a guarantee that going digital would increase profits, and 58% say transport fees need to be reduced in order to operate efficiently online.

Then there’s the educational barrier to entry: One-fifth (22%) of retailers say it’s too complicated to set up and run a digital store, while 10% simply don’t know how. Thirty-six percent say they’d like a single, streamlined solution that guides them through the transition from start to finish.

Other avenues of growth

A passion for local goods

Another opportunity for growth lies in showcasing independent retail’s role as a go-to for local finds. When compared to larger chains, almost six in 10 (58%) consumers say the benefit of shopping at independent stores is being able to support their local community.

While the average retailer says they source half (48%) of their products locally, the real challenge is growing that number: Those same retailers predict they’ll only be able to source 54% of their goods locally in the next five years.

Cost and availability could definitely be the culprits here, with 42% of retailers saying local sourcing is too expensive and 33% saying they can’t get the products they want and need. On the flip side, 30% say international stock is poor quality – compared to only 14% for local goods – so it could be worth spending extra.

Going abroad is likely not the answer for retailers, with 34% admitting that sourcing international goods is one of the biggest current challenges for their business. Just over half (55%) say the supply of overseas stock is too slow, and 51% say it’s too expensive.

Retailers can get the products their customers want with wholesale technology, like Faire, which makes sourcing quality goods both easier and cheaper. In fact, since the UK left the European Union, Faire’s support has enabled the sale of over 8 million products, saving retailers and brands over £21 million in shipping and import costs.

The draw of in-store events

As the supply chain continues to recover from the pandemic, consumers have returned to everyday life – and regained an appetite for in-person engagement. Given that fostering a sense of community is one of the cornerstones of independent retail, it’s no surprise that consumers are drawn to in-store events.

Half of respondents (49%) say they’d attend an event thrown by an in-store independent retailer, and a fifth (19%) say they already have. Of those who would like to, 61% say it’s because they’d want to try new products, 50% want new discounts, 43% want to discover new brands and 34% want to socialise with their community.

There is a clear opportunity here, as chains and online-only brands simply cannot compete with resourceful brands willing to invest in throwing dynamic events for their community, like an in-person tasting, meet-and-greet or product launch.

The role of government, and a promising future

While retailers and consumers can certainly drive the growth of independent retail, 88% of SMB leaders think that the government needs to do more to help the independent retail sector; 62% of consumers agree and think that brands (11%), wholesalers (9%) and charities (4%) should pitch in, too.

The world of independent retail is evolving, and this research shows that enterprising retailers can take advantage of various opportunities to meet consumers where they’re at – both online and in person. To be sure, the British people are ready to show up for their communities, support their local shops and revive independent retail, one purchase at a time.

How we did it

This research was conducted by Opinium Research on behalf of Faire via two online surveys between 30 January 2023 and 8 February 2023. This included one sample of 100 independent retailers (<50 employees) and one sample of 2,000 UK adults nationally representative of the UK population.

About Faire

Faire is a wholesale marketplace taking a data-driven approach to helping local, independent retailers stock their shelves with high-quality goods from the best brands and artisans. Faire retailers rely on the wholesale platform for the convenience of ordering from thousands of their favourite brands all in one place, net-60 payment terms, free returns on opening orders and freight caps. For brands, the platform provides powerful sales, marketing and analytics tools, so sellers can simplify their wholesale business and focus on making great products.