The following content is informational only. When making business and legal decisions, we encourage you to seek personalized advice from qualified professionals.

Given the prolonged uncertainty caused by COVID-19, many commercial businesses are facing a new financial challenge—handling rent payments. For retailers, meeting rent due dates while experiencing temporary store closures or reduced foot traffic is increasingly challenging, and causing a new kind of financial strain.

That said, there are steps you can take to find relief. Taking early action to understand your financial situation, reviewing your lease options, monitoring local legal developments, and communicating with your landlord can all help you get more accessible cash for your business.

Here are some actions you can take.

1. Understand your financial health

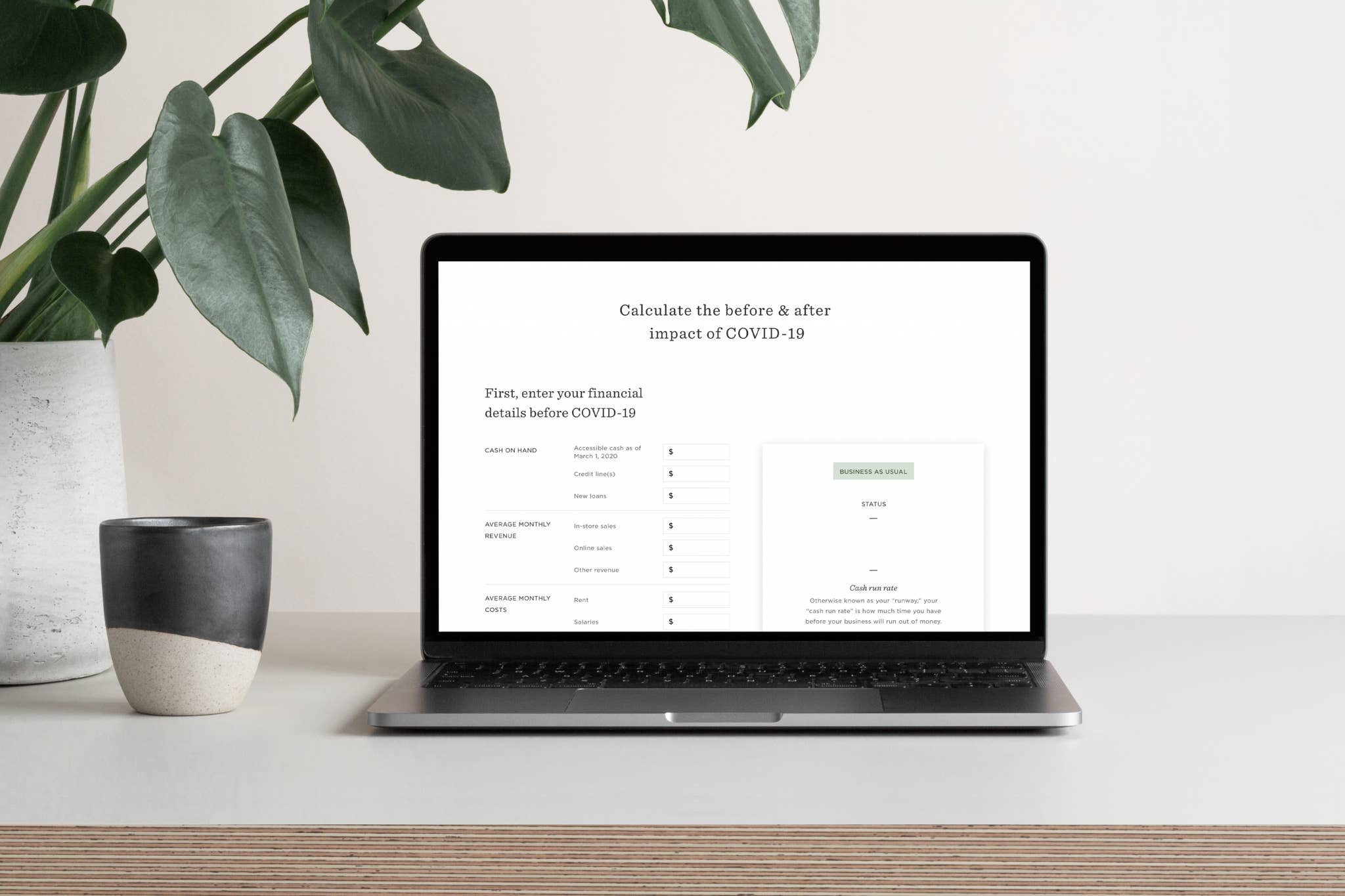

Getting a clear picture of your business’s cash run rate is a great step to take when assessing your commercial rent during this uncertain time.

We built a financial planning tool to help you understand the potential impact of COVID-19 on your business and see immediate next steps you can take, including applying for federal aid.

2. Review your commercial lease agreement

- Review your commercial lease to understand if there is specific language relevant to what’s going on and what options you have within the terms of your contract. Whether or not you seek grounds through this contract as a basis for relief, it’s important to understand your agreement with your landlord. There can be limitations to what your landlord is legally and financially permitted to do, especially if the landlord’s lenders are included in the agreement.

- Look for these terms and phrases in your rental agreement to aid negotiations with your landlord and provide the basis for relief:

- Terms that apply directly to the COVID-19 pandemic: “epidemic,” “pandemic,” “contagious disease” or “public health emergency.”

- Pay particularly close attention to clauses relating to “force majeure,” commercial insurance, subletting/licensing, “go dark” default, “condemnation/casualty” provisions, late payment penalties, co-tenancy requirements, or bankruptcy.

- You may want to consider talking with an attorney about your commercial lease to understand what options are available to you. Keep in mind, this can be time-consuming and costly so it depends heavily on your specific set of circumstances. If you can’t afford an attorney, there are legal services that do free consultations with small business owners, including small business clinics at many law schools and non-profit organizations.

3. Talk to your landlord about reducing rent

You may want to discuss rent concessions, forgiveness, or delays with your landlord until things have stabilized after working through the steps above.

- Rent forgiveness: If there is any potential that you will not be able to pay your upcoming rent bill, reach out to your landlord as soon as possible. Being proactive can help you best manage the situation and plan for the future. Now, more than ever, we need to rely on our community for support and relief from a month’s rent can go a long way. Consider a thoughtful email to your landlord explaining your situation and the need for immediate relief. The course of action most appropriate for your business may vary, but thoughtful and timely communication with your landlord will be key.

- Partial payment or rent deferral: If you are unable to pay the rent in full, consider seeking partial forgiveness, setting up a payment plan to defer rent payments, or applying part of your security deposit to your current payment due. For example, you may be able to add any missed payments as extra months at the end of your lease. Landlords will likely be more receptive to you paying at least some of the rent with a schedule in place for the outstanding balance compared to a payment suspension.

Finding a way to start a conversation with your landlord about alternative plans for paying rent may prove challenging. Depending on the situation and the existing relationship with your landlord, your approach may vary. Keeping the following in mind may help you structure your approach:

- Openness and honesty: Being open, honest, and succinct could help your landlord understand the gravity of the situation, and empathize with you.

- Empathy: Showing an understanding and willingness to learn about the situation your landlord finds herself in could provide amicable grounds for working to find a solution.

- Cooperation: Being willing to cooperate with your landlord in devising an agreeable solution will be key in maintaining a good relationship and creating a sustainable plan.

Consider how your current communications and actions during this time could be viewed by an arbitrator in the future in the event there is any type of dispute proceedings, as you maintain a record of correspondence with your landlord.

Your landlord may want to see that you’ve sought out federal, state, or local relief programs or your financials before entering into any negotiations with you. This is an opportunity to remind the landlord of why they should work with you by showing you’ve taken all the right steps along with a strong payment history and/or your strong credit score.

As you maintain a record of correspondence with your landlord, consider how your current communications and actions during this time could be viewed by an arbitrator in the future in the event there is any type of dispute proceedings.

Example email to landlord:

4. Stay informed on state and local legal developments

- Follow guidance from your state and local government, and understand any local restrictions on travel or commerce.

- Get more info from the chamber of commerce in your state and from your local Small Business Administration (SBA) office. You can find updates on how each State has responded to COVID-19 through emergency action on the National Governor’s Associations website.

- Pay close attention to state and local grants, eviction protections, and other governmental directives to evaluate their impact on your businesses.

5. Explore additional ideas & resources from Faire

If you have business interruption insurance, your policy may include rent-related coverage. Every policy is different, and many policies may require physical loss or damage for coverage. However, reaching out to your insurance broker to see if you should file a claim is the right first step to know what’s right for you.

To help our community to take immediate action, we’ve published and compiled the following additional resources:

- Resource hubs

- Spreadsheets

- Articles

Our team will continue to share all the information currently available to us, in order to help you make informed decisions for your business.

Please stay safe, stay connected, and join the conversation in our community forum.